Contents:

In activity-based costing, the consumption of overhead resources is caused by ______. In activity based costing another term for activity measure is ______. This system is more time-consuming due to the fact that the number of activities to which the overhead resources of an organization have to be related, is very large. The cost assignment view provides information about resources, activities and cost objects.

Costs must be assigned to the cost pools for a specified time period. The main objective of activity-based costing is to determine the actual costs that go into the production of a certain product. Its purpose is to include indirect costs to have a better understanding of the overall costs.

Why Healthcare Needs Activity-Based Costing

It was established in 2012 by the AICPAandCIMAto recognise a unique group of management accountants who have reached the highest benchmark of quality and competence. The CGMA designation is built on extensive global research to maintain the highest relevance with employers and develop the competencies most in demand. CGMA designation holders qualify through rigorous education, exam and experience requirements. “Over the past 15 years, ABC has enabled managers to see that not all revenue is good and not all customers are profitable customers.”

In the 1980s, the authors Robin Cooper and Robert Kaplan wrote numerous articles about this. The extra time for changeovers to clean out allergens used in certain ice cream products could now be accurately assigned to those products. The model also captured the extra packaging costs for special promotions and customer-specific labels and promotions.

Example of Activity Based Costing

Under the activity-based approach, the unit cost card gives different unit product costs for each product. Batch-level activities are used in activity-based costing to identify manufacturing cost-drivers. Additionally, many companies rely on customisation of products to differentiate themselves and to enable higher margins to be made. Dell, for example, a PC manufacturer, has a website which lets customers specify their own PC in terms of memory size, capacity, processor speed etc.

- Estimates and allocations are inherent in these methodologies, and they don’t capture healthcare resource use at a granular level or provide actionable intelligence.

- Hence, more accurate results of the cost allocation can be expected using the ABC system.

- 5) Assign manufacturing overhead costs for each cost pool to products, using the overhead rates.

- Learn the definition of activity-based costing and understand its different benefits with examples.

- In the following example of one health system’s clinical variation in a lumbar spinal fusion procedure , throughout 852 procedures, service center costs were nearly half of the total cost.

Of the problem mitigation suggestions noted here, the key point is to construct a highly targeted ABC system that produces the most critical information at a reasonable cost. If that system takes root in your company, then consider a gradual expansion, during which you only expand further if there is a clear and demonstrable benefit in doing so. The worst thing you can do is to install a large and comprehensive ABC system, since it is expensive, meets with the most resistance, and is the most likely to fail over the long term. An ABC system may require data input from multiple departments, and each of those departments may have greater priorities than the ABC system.

Healthcare Activity-Based Costing—the Most Efficient Path to Strategic Cost Transformation

An activity may be a very small activity but it should justify the cost incurred for it. An activity may be a single activity or combination of several activities. Cost-benefit analysis of each and every activity may be undertaken to judge the worthiness of activity. The final words of comment over ABC system are that adoption, implementation and operation of the system is not an end in itself. The benefits can be derived by translating the system design and its operation into action-oriented managerial performance. Ultimately, it amounts to effective cost management for the success of the system.

Cost Accounting: What It Is And When To Use It – Forbes

Cost Accounting: What It Is And When To Use It.

Posted: Thu, 18 Aug 2022 07:00:00 GMT [source]

Select all that apply Costs that can be easily traced to individual products include ______. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

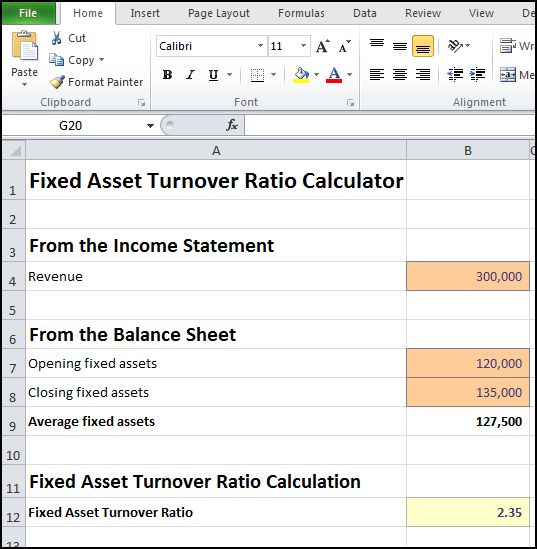

The Institute of Cost & Management Accountants of Bangladesh defines activity-based costing as an accounting method which identifies the activities which a firm performs and then assigns indirect costs to cost objects. In contrast, for the luxury product, manufacturing overhead costs based on labor hours were higher when compared to the activity-based approach. When considering all relevant activities, overhead costs in manufacturing each product are actually less than that estimated by labor hours only. Let’s continue with our example from earlier; the total fixed overheads were $224,000. In the table below in Example 2 the total overheads have been split into cost pools and cost driver data for the Ordinary and Deluxe products has been collated.

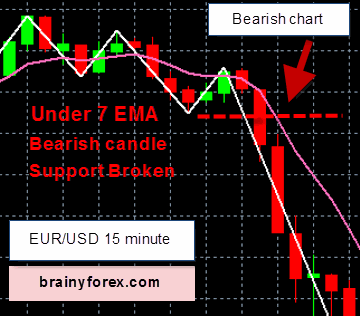

So, if product-A has consumed more quality inspection visits, a higher cost of the quality inspection will be allocated for product-A and vice versa. Traditional Activity-Based Costing software can best be compared to a waterfall where costs only flow down, whereas a ‘pull’ (or Time-driven) Activity-Based Costing model looks like a two-directional water system. Here, costs can flow up and down thanks to the use of a more dynamic cost driver that adapts to the volume produced. Both are Activity-Based Costing, but one is more static and traditional whilst the other is more dynamic.

The factors which influence the cost of a particular activity should identified, which are known as Cost Drivers. ABC is based on the assumption that cost behavior is influenced by cost drivers. It should be noted that directs costs do not need cost drivers as they can be identified directly to a product. Therefore cost drivers signify factors, forces or events that determine the costs of activities.

You might consider going with traditional costing if you only make a few products. The estimated number of units then divides the projected costs of each activity in the activity to reach an overhead activity rate that is used to charge overheads to each product, job, or service depending on the number of units. Service businesses can also use activity-based costing to determine whether the services offered are accurately priced. Usually, traditional costing ______ high-volume products and ______ low-volume products.

Key Takeaways on activity based costing

Duration drivers establish an average hourly rate of performing an activity while intensity drivers involve direct charging based on the actual activity resources relevant to a product. Generally, the products are cost objects, but the customers, services or locations can also be the cost objects. It charges overhead cost to product according to activities involved in the product instead of using average overhead distribution rate as in case of traditional method.

- Activity Based Costing establishes relationship between overheads costs and activities in order to ensure that the overheads costs are more precisely allocated to products, services or customers segments.

- There is no need to conduct surveys, although in large organizations, surveying employees may help.

- It includes direct material, direct labor, production overhead, and non-production overheads.

- As a solution, PowerCosting links seamlessly to an organization’s chosen visualization tools (e.g.,QlikView®,Tableau,Power BI, etc.) with both pre-populated and ad hoc capability to deliver business intelligence.

- You can compare the true cost of making different products, see if they’re bringing in enough profit and take action accordingly.

ABC serves as a decision-making tool for degerming the profitability of a product or service. For more resources, check out our business templates library to download numerous free Excel modeling, PowerPoint presentation, and Word document templates. Kristen has her Bachelor of Arts in Communication with certificates in finance, marketing, and graphic design.

It means, in what is an enrolled agent costing system, cost of batch level, product level and facility level activities is fixed costs, i.e., costs of these do not change as production volume changes. Unit-based cost systems apportion fixed overhead to individual products and variable overheads are directly assigned to products using the base of number of units produced. Direct labour and materials are relatively easy to trace directly to products, but it is more difficult to directly allocate indirect costs to products. Where products use common resources differently, some sort of weighting is needed in the cost allocation process. The cost driver is a factor that creates or drives the cost of the activity.

Web Beacons: How To Effectively Use Them For Phishing Detection – Security Boulevard

Web Beacons: How To Effectively Use Them For Phishing Detection.

Posted: Thu, 13 Apr 2023 15:53:42 GMT [source]

You now have a precise idea of your https://1investing.in/s, which obviously leads to a more exact budget and clearer business planning. You can see where your money is being spent and which products are going to make you the most profit. You can compare the true cost of making different products, see if they’re bringing in enough profit and take action accordingly. 300 of these new machines are for your new product, and you want to factor this into working out the overall cost of production to predict if it will be profitable.