True alternatives will provide the ability to manage a business’s accounting books, send payments, create and send invoices, collect payments, and budget. Some of the most popular alternatives to QuickBooks include Xero, FreshBooks, Sage, Zoho, and Wave. QuickBooks also offers both a desktop version for a fixed fee and an online version accessible through your web browser, tablet, or smartphone for a monthly or yearly subscription. Some features, such as payroll management and payment processing, incur an additional fee regardless of which version you choose.

Business owners need a more robust finance and accounting software solution and trustworthy financial management guidance to monitor and guide their enterprise’s strategic directions. The FaaS solution provides accurate financial models and visualizations that allow them to execute with confidence. QuickBooks Point of Sale is software that replaces a retailer’s cash register, tracks its inventory, sales, and customer information, and provides reports for managing its business and serving its customers.

Paychex Review Pricing Plans Features (

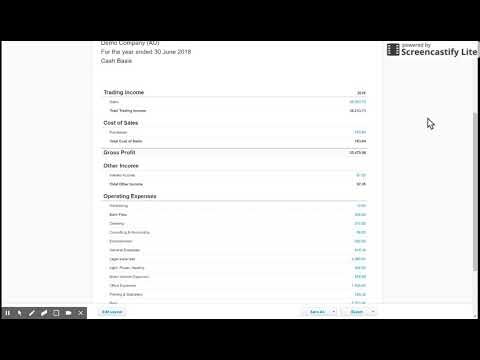

From income and expenses to profit and loss, QuickBooks generates financial statements instantly. But receiving payments in multiple currencies can be a time-consuming and pricey process. Contingent Asset: Overview and Consideration Once you select your business plan, you can also optionally add a payroll plan. For freelancers, the ‘self-employed’ plan covers everything from tax deductions to basic reports.

- Two of the most important types of reports for accountants and chief financial officers are balance sheets and income statements.

- From income and expenses to profit and loss, QuickBooks generates financial statements instantly.

- Once you switch it on for your account, pay and receive funds in a variety of currency types.

- With a FaaS model, you won’t feel the lack of metrics and analytics because your FaaS provider will leverage enterprise-level accounting and finance software to provide better financial data.

- You may have customers and suppliers with whom you transact using a currency different from your country’s default (“home”) currency.

- QuickBooks is designed as a generic accounting and bookkeeping platform for a wide variety of businesses, and it fulfills its purpose.

Another cumbersome workaround is to use QuickBooks’ invoicing feature to create an invoice for each revenue-generating transaction. This is a major gap, as revenue recognition is a key accounting principle. Without proper revenue recognition, a company’s income statements will be inaccurate and could mislead investors and creditors. The QuickBooks UK edition also includes support for Irish and South African VAT. SchoolCues is an all-in-one school management system for small schools with limited budgets and resources.

This can have a significant impact on the timing of revenue recognition for some businesses. For example, if a company delivers a one-year subscription service on January 1st, the entire subscription fee would be recognized as revenue on that date under ASC 606. Under previous guidance, the company could have recognized the revenue over the course of the year as the service was delivered. As well, application integration provides a competitive advantage by giving employees access to data and information that would otherwise be unavailable. When applications are integrated, an organization can make better use of customer data, market research and other types of information. This access to data and information can give an organization a leg up on the competition.

No more lost receipts or manually matching up receipts with downloaded bank statements. QuickBooks allows you to attach a receipt to the corresponding banking transaction. The QuickBooks Online app has a scanning tool so you may scan receipts. You’ll simply take a photo of your receipt, upload it into the system, review it for inaccuracies, and save it.

How Does QuickBooks Work for Personal Finances?

She also regularly writes about travel, food, and books for various lifestyle publications. If you’re a startup with plans of expanding your workforce, QuickBooks Self-Employed won’t be the best fit as it cannot be upgraded to other QuickBooks versions. In addition to some native QuickBooks Online integrations—such as QuickBooks Payroll, QuickBooks Time, and QuickBooks Payments—QuickBooks Online connects with popular apps.

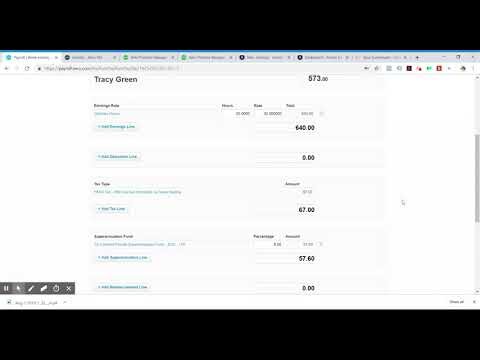

QuickBooks hosting lets you access your desktop software anywhere through a remote server, and a good place to start would be our list of the best QuickBooks hosting providers. Our guide on how to convert QuickBooks Desktop to Online walks you through the simple process. This expertise can be helpful with setting up your accounting processes, troubleshooting issues, and maximizing the software’s capabilities. QuickBooks users can invite an accountant to view their books, and QuickBooks Desktop users are able to export an accountant copy and import any changes the accountant has made to their file. The best thing about using QuickBooks Payroll is that it’s integrated with QuickBooks, so your financial statements are always up to date as of the latest payroll run.

QuickBooks offers a lot of tools, but one of its greatest features is that it automates your bills and tracks expenses by seamlessly connecting to your bank accounts and credit cards. This means you’re automatically able to balance your accounts to make sure you have enough money in to cover the money out. Once set up, you can have a full financial picture of your business’s performance, at any given time. The QuickBooks Online mobile app allows you to execute various accounting tasks from your mobile devices.

QuickBooks Software Options

You may use QuickBooks Online from any location thanks to its cloud-based subscription service. Any device with an internet connection can be used to access your account. The accounting programme has a version specifically made for Mac users called QuickBooks for Mac.

You can also enter bills into QuickBooks when you receive them so that QuickBooks can help you track upcoming payments. You can ensure that you pay your bills on time by creating an accounts payable (A/P) report. This report will provide you with the details of your current and past-due bills. The ability to pay bills and track unpaid bills is available in QuickBooks Essentials and higher plans. Invoicing is one of the most crucial functions for many businesses, especially those that provide services or rely on freelancers.

QuickBooks Business Checking Review 2023

You can also use QuickBooks’ ProAdvisor network to find certified accountants and bookkeepers. Given QuickBooks Online’s number of users, accountants outside of the network should be familiar with the software. Competitors like Xero and FreshBooks offer basic inventory tracking for less, but it isn’t as advanced. You aren’t required to fill out every field in an expense or income entry, but the more detailed your records are, the more useful certain reports can be.

This means the transaction will then be posted to the correct account, be that your bank account or your credit card. Are you ready to streamline your financial reporting process and save valuable time? Book a demo with LiveFlow today and witness how it simplifies your reporting process. QuickBooks is used by businesses of all sizes, from small startups to large corporations. According to Intuit, the company behind QuickBooks, over 7 million businesses use QuickBooks.

The Home & Business version includes the ability to track rental properties and small businesses in addition to your personal information. Advanced sales and customer relationship management functionality can be obtained by integrating Pipedrive CRM. An array of additional integrations can be achieved either through the integrations hub Zapier or by using the open API included in the Unlimited package of MRPeasy.

Although QuickBooks Online is user-friendly, there can be a learning curve, particularly if you’re unfamiliar with the basic principles of accounting. Additionally, QuickBooks can be expensive for many businesses, even more so if you add on time tracking or payroll. Large companies often have complex financial needs that go beyond what QuickBooks can offer.

For executives at growing companies who want to make data-driven decisions, Sage Intacct provides real-time financial insights. Sage Intacct is a true cloud-native financial management system, built in the cloud for the cloud, and offers simplified integration with other cloud-native platforms such as Salesforce. There are numerous benefits to integrating software applications within an organization. When software applications are integrated, there’s often no need to purchase duplicate licenses or maintain multiple copies of data. In addition, integrating applications can eliminate the need for manual data entry, which can save both time and money.